Top Mistakes in Business Expense Reports

Expense reports are a common source of errors that can cost businesses millions every year. Manual processes like spreadsheets and paper receipts often lead to issues such as duplicate payments, missing receipts, incorrect categorization, and inflated mileage claims. These mistakes waste time, delay reimbursements, and increase the risk of audit problems.

Switching to digital tools, such as EasyTripExpenses, can help solve these problems by automating receipt tracking, categorization, and policy checks. This not only reduces errors but also saves time and ensures compliance. Businesses using automated systems report faster processes, lower costs, and improved financial accuracy.

Key Takeaways:

- Manual Expense Reporting Issues: High error rates, time-consuming processes, and financial losses from duplicate payments or missed tax deductions.

- Digital Tools Benefits: Lower error rates, faster reporting, and secure storage for audits.

- Cost Comparison: Manual processes lead to inefficiencies, while tools like EasyTripExpenses start at $9/month and offer free trials.

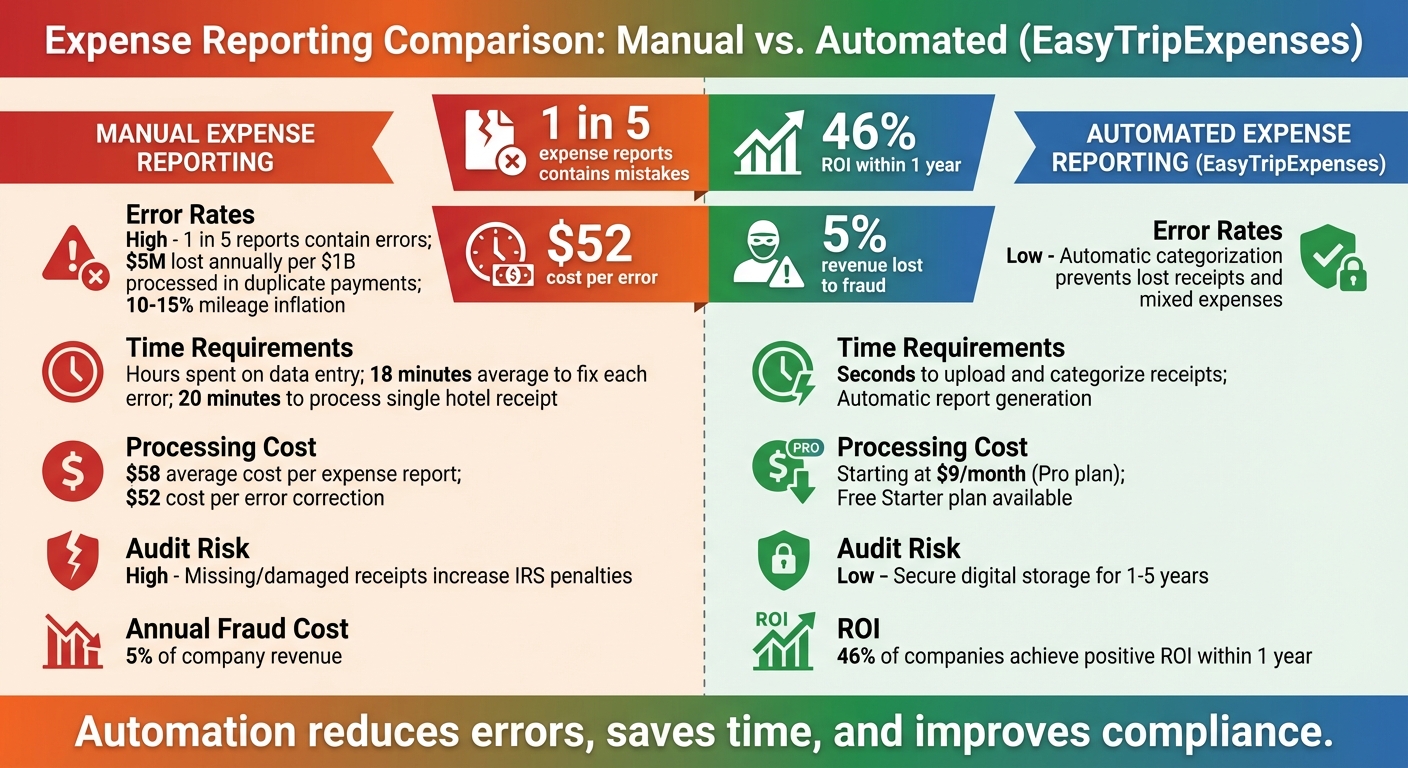

Quick Comparison:

| Aspect | Manual Reporting | EasyTripExpenses |

|---|---|---|

| Error Rates | High due to manual entry and lost receipts | Low with automated categorization |

| Time Requirements | Hours spent on data entry and tracking | Seconds with automated uploads |

| Costs | Financial losses from errors and inefficiency | Affordable plans starting at $9/month |

| Audit Readiness | Risky with missing or damaged receipts | Secure digital storage for 1–5 years |

Automating expense reporting can save time, reduce errors, and improve financial management, making it a smart choice for businesses of all sizes.

Manual vs Automated Expense Reporting: Cost and Efficiency Comparison

1. EasyTripExpenses

Error Reduction

EasyTripExpenses simplifies expense reporting by automating tasks that often lead to errors in manual systems. With its receipt capture feature, you can snap a photo of your receipts, and the platform securely stores and categorizes them. This eliminates the risk of losing receipts and ensures they’re accurately filed.

The software uses predefined categories aligned with your company’s chart of accounts to automatically sort expenses. This reduces the chances of misclassification and frees up your finance team to focus on more strategic work. By automating these processes, EasyTripExpenses not only minimizes mistakes but also speeds up the entire expense reporting workflow.

Efficiency

EasyTripExpenses makes creating expense reports a breeze. You can upload receipts as images or PDFs, add notes, and generate reports in PDF or Excel formats - all from one place. For international travelers, the built-in currency converter saves time by automatically converting euros, pounds, or yen into U.S. dollars.

The platform is user-friendly and doesn’t require IT support, making it ideal for small teams or startups. If you’re on the yearly Pro plan, your trip history is stored for up to five years, which is incredibly helpful for audits or budget planning. Its quick and accurate reporting tools make financial management smoother and more efficient.

Cost

By automating receipt organization and categorization, EasyTripExpenses tackles the errors that often come with manual handling.

The platform offers a free Starter plan, allowing you to test it with up to five uploads per trip and one active trip at a time. For more advanced needs, the Pro plan starts at $9.00/month, with annual subscriptions providing added savings. This flexible pricing ensures businesses of all sizes can take advantage of EasyTripExpenses.

2. Manual Expense Reporting

Error Reduction

Relying on manual methods for expense reporting often leaves companies vulnerable to costly mistakes. Unlike digital tools that simplify the process, manual reporting is riddled with human error. Employees filling out expense reports by hand can easily make mistakes like typos in transaction amounts, duplicate entries, missing receipts, or coding errors. These mistakes can snowball, leading to inaccurate cash flow projections, budget discrepancies, and even instances of fraud.

For example, one study revealed that businesses lose $5 million annually to duplicate payments for every $1 billion processed. Errors like these, along with inflated mileage claims, can seriously strain cash flow. When finance teams are left sifting through piles of paper receipts and spreadsheets, catching every mistake becomes nearly impossible. This not only disrupts financial accuracy but also slows the entire reporting process.

Efficiency

Manual expense reporting is also a major time sink. Employees often delay submitting reports, lose track of receipts, and spend excessive time re-entering data. What should be a quick task can stretch into hours as team members search for missing documents or wait on approvals. Additionally, manual processes make it nearly impossible to monitor expenses in real time. Overspending or budget problems might go unnoticed until it’s too late, leaving little room for proactive financial planning. These delays and inefficiencies ultimately increase operational costs and take time away from more strategic initiatives.

Cost

The financial toll of manual expense reporting goes beyond inefficiency. Companies often lose money due to missed tax deductions, over-reimbursements, and inaccurate reporting. Misplaced receipts can mean legitimate expenses go unclaimed, while errors in categorization can lead to compliance issues or penalties during tax audits. In some cases, the cost of processing a single invoice may even surpass the value of the expense itself. When you factor in wasted employee time and heightened audit risks, it’s clear that manual expense reporting drains resources that could be better spent elsewhere.

Automating expense reports with AI

sbb-itb-386cb5b

Pros and Cons

When choosing between manual expense reporting and a digital tool like EasyTripExpenses, it’s important to weigh the benefits and drawbacks. The table below highlights the key differences, giving you a straightforward comparison:

| Aspect | Manual Expense Reporting | EasyTripExpenses |

|---|---|---|

| Error Rates | High error rates due to manual data entry and poor record management. Manual mileage tracking can result in 10–15% mileage inflation. Companies lose $5 million annually to duplicate payments for every $1 billion processed. | Lower error rates thanks to digital receipt storage and automatic categorization. This prevents issues like lost receipts or mixing personal and business expenses. |

| Time Requirements | Manual processes take hours for data entry and finding documents. Year-end reconciliation often turns into a stressful hunt for missing details. | Receipts are uploaded and categorized in seconds. Reports are automatically generated in PDF or Excel formats, eliminating the need for manual data entry. |

| Costs | Financial losses occur due to missed tax deductions, inflated claims, and wasted employee time. Processing costs can even exceed the value of the expense itself. Messy records may require expensive cleanups. | Better visibility into spending reduces losses from duplicate payments and inflated claims, while uncovering cost-saving opportunities. The pricing is straightforward, starting with a free Starter plan, and the Pro plan is $9.00/month with an annual subscription. |

| Compliance & Audit Risk | Keeping accurate records can be difficult. Missing or damaged receipts increase audit risks and the chances of IRS penalties. | Digital records are securely stored for 1–5 years (depending on the plan), making them easily accessible and audit-ready. |

Conclusion

Manually managing expense reports can lead to errors, wasted time, and increased compliance risks. Did you know that one in five expense reports contains mistakes? Each error takes an average of 18 minutes and costs $52 to fix. These inefficiencies add up quickly, creating unnecessary headaches for businesses.

Automation tools like EasyTripExpenses tackle these challenges head-on. With features like digital receipt storage, you can say goodbye to misplaced or damaged documents. Automated categorization ensures personal and business expenses don’t get mixed up, and reports are generated in seconds - no more spending hours on tedious tasks. The numbers speak for themselves: companies that adopted cloud-based expense systems reported that 46% achieved positive ROI within a year. This success is driven by reduced processing costs, increased employee productivity, and better compliance with company policies. Additionally, automated systems help curb fraud, which typically costs organizations around 5% of their annual revenue. These tools catch duplicate claims and policy violations before they spiral into costly problems.

For smaller teams and startups, solutions like EasyTripExpenses offer flexible pricing, making it affordable to manage expenses efficiently. Consider this: processing the expense report for a single-night hotel stay costs an average of $58 and 20 minutes of work. With automation, those costs and efforts shrink dramatically. Plus, digital records are stored securely for up to five years, turning audits into a breeze instead of a nightmare.

Automating expense reporting doesn’t just save time and money - it completely transforms the process. By eliminating errors and streamlining operations, it turns what was once a costly hassle into a smooth, efficient system.

FAQs

How does automating expense reports help minimize errors?

Automating expense reports takes the headache out of manual data entry, cutting down on typos and calculation errors. It also helps catch duplicate entries, ensures expenses are properly categorized, and keeps everything in line with company policies and tax rules.

This approach not only saves time but also boosts accuracy and delivers polished, audit-ready reports. Plus, it eases the burden of managing expenses, making the whole process smoother and less stressful.

What are the cost-saving advantages of using EasyTripExpenses?

Using EasyTripExpenses streamlines expense management by automating tasks that often eat up valuable time, such as tracking receipts, categorizing expenses, and generating reports. This not only cuts down on errors but also speeds up reimbursements and reduces the burden on administrative staff.

The platform also offers secure data storage and built-in currency conversion, making it simpler for teams to handle expenses without distractions. These features help employees stay organized and concentrate on what truly matters - getting their work done.

How does EasyTripExpenses help ensure compliance and simplify audits?

EasyTripExpenses takes the hassle out of compliance and auditing by automating essential tasks like enforcing company policies and tracking expenses. It instantly identifies out-of-policy expenses, minimizing mistakes and ensuring all spending aligns with company rules.

The platform's well-organized record-keeping - complete with categorized expenses and digital receipts - makes audits quicker and smoother. By maintaining precise and easily accessible documentation, it not only saves time but also bolsters compliance efforts.