Real-Time Expense Tracking for Small Teams

Real-time expense tracking simplifies financial management for small teams by automating processes and providing instant visibility into spending. Instead of dealing with paper receipts and manual spreadsheets, these systems sync transactions automatically, categorize expenses, and flag issues immediately. This saves time, reduces errors, and improves cash flow oversight.

Key Benefits:

- Immediate insights into spending as it happens.

- Automatic categorization and fraud detection.

- Faster reimbursements and fewer manual tasks.

- Compliance with IRS rules through secure digital record-keeping.

How It Works:

- Syncs corporate card transactions in real time.

- Uses mobile apps and AI to log receipts and categorize data.

- Integrates seamlessly with accounting tools like QuickBooks.

How to Keep Track of Small Business Expenses

How Real-Time Expense Tracking Works

Real-time expense tracking systems replace outdated, manual methods with automated workflows that instantly capture, categorize, and sync expense data. This provides a live view of your financial status, removing the need for time-consuming month-end reconciliations. With this level of clarity, businesses can make smarter spending decisions. Let’s explore the key features that make these systems so effective.

Main Features of Real-Time Expense Tracking

At the heart of any real-time tracking system lies instant data capture. Mobile apps allow users to snap a photo of a receipt, while AI extracts key details like vendor names, amounts, dates, and categories. This eliminates the need for manual data entry, reducing errors and saving time.

Another critical feature is automatic categorization. Expenses are sorted into categories like travel, meals, or office supplies without requiring manual input. This ensures consistency across the board and simplifies financial reporting. Additionally, real-time policy enforcement flags any spending that exceeds limits or breaks company rules before the expense is approved. This proactive approach prevents issues from snowballing later.

Software integrations pull everything together seamlessly. These systems sync directly with accounting platforms like QuickBooks, ensuring that expense data flows smoothly into your financial records. Double-entry work becomes a thing of the past, and your books stay up-to-date. Shafak Ilyas, Senior Accountant at Shortcut, shared how this transformation saved time:

"Everything is quicker. I can sync whenever I want. Closing the books used to take a couple of days, and now it takes about an hour a month".

Where Expense Data Comes From

Real-time tracking systems gather data from multiple sources to ensure nothing slips through the cracks. Corporate card transactions are synced automatically, so purchases show up in the system as soon as they’re made. For expenses paid with personal cards or cash, receipt uploads via mobile apps make the process simple - just snap a photo, and the system handles the rest. For businesses with field staff, GPS-based mileage tracking automatically logs business travel without requiring manual input.

This multi-source approach means you’re not relying on employees to remember every purchase or save every receipt. As Teo Evanick, Controller at Mode Analytics, explains:

"The faster we can analyze and review data, the better".

When Mode Analytics implemented real-time tracking with detailed visibility at the merchant, department, and employee levels, they could address spending patterns immediately instead of weeks later. Beyond capturing data, these systems also help businesses meet regulatory requirements.

US Tax and Record-Keeping Requirements

The IRS has clear rules for expense documentation, and real-time tracking systems make compliance easier. For business travel expenses, receipts are required for any expense over $75, though it’s wise to document all expenses. Each record should include the amount, date, location, and business purpose.

Record retention is equally important. The IRS mandates that businesses keep expense records for at least three years from the date a tax return is filed. Real-time tracking systems securely store digital copies, making audits far less stressful. They also maintain audit trails that log who approved each expense and when, which is essential for both internal controls and external compliance. By automating documentation and storage, these systems ensure businesses are prepared for tax season without the usual last-minute panic.

Benefits and Challenges of Real-Time Expense Tracking

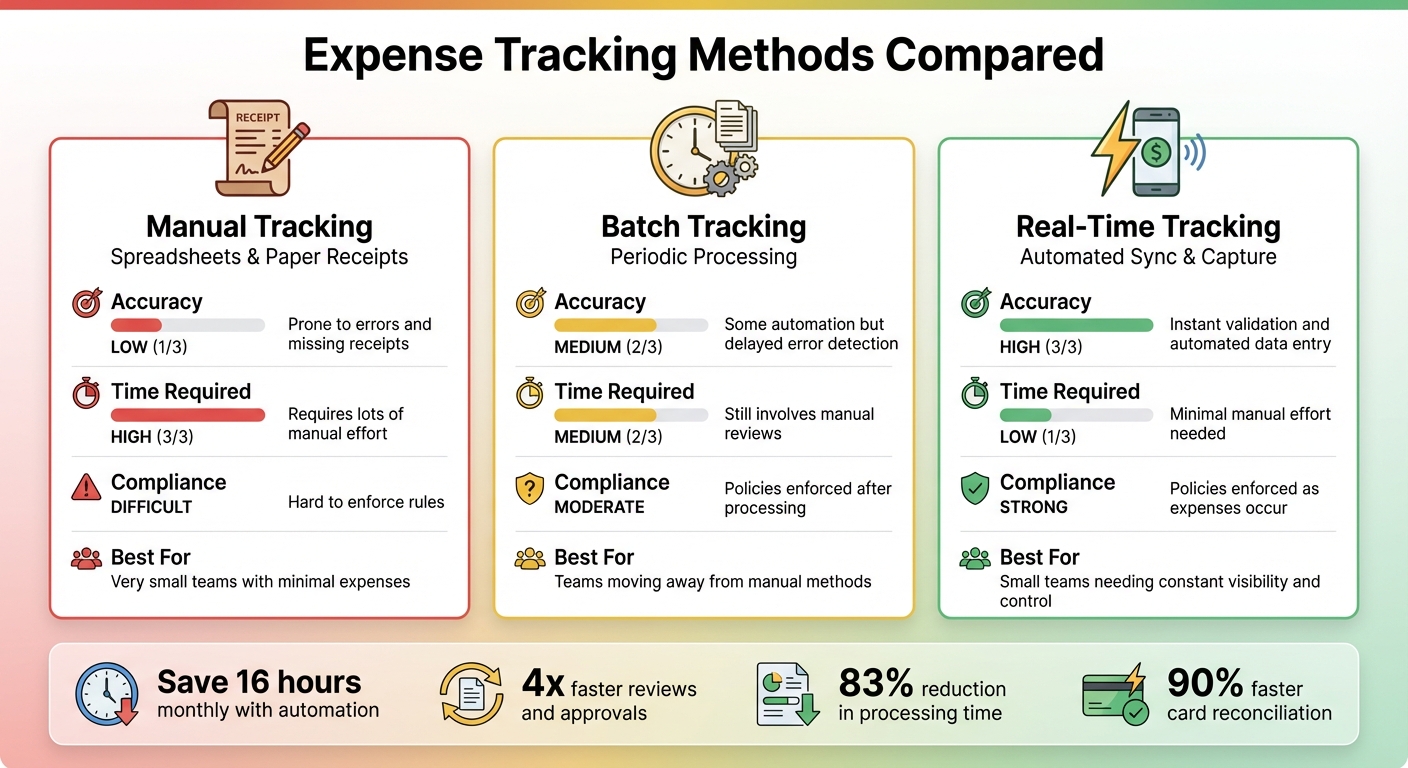

Comparison of Expense Tracking Methods: Manual vs Batch vs Real-Time

Now that we’ve covered how real-time expense tracking works, let’s dive into its impact on small teams, exploring both the advantages and the challenges it brings.

Main Benefits for Small Teams

Real-time expense tracking keeps transactions synced instantly, giving teams a clear view of spending patterns. This level of transparency helps spot errors or potential fraud early, allowing teams to address them before they disrupt budgets. It’s a powerful way to maintain better control over costs.

Another big plus? Faster approvals and reimbursements. When expenses are logged and processed right away, team members don’t have to wait long to get reimbursed. Plus, automating the capture of expenses cuts down on tedious admin work. This frees up finance teams to focus on bigger-picture decisions instead of being bogged down by manual data entry.

Real-time data also means teams can act quickly to prevent overspending. Budgets can be adjusted in the moment, helping ensure tighter financial management overall.

Common Problems and How to Avoid Them

Without real-time visibility, teams risk budget overruns, inaccurate forecasts, and delays in cost-cutting efforts. When decisions rely on outdated data, problems often surface too late to fix effectively.

Manual workflows are another common pain point. They’re prone to errors, slow things down, and frustrate staff. Paper receipts and manual forms increase the chances of losing critical information or making mistakes.

Unclear expense policies can also create confusion and compliance headaches. To tackle these issues, start by developing clear, straightforward policies that outline spending limits, required documentation, and approval workflows. Automated systems can enforce these rules by flagging problems before expenses are approved. Make sure your team is trained on the process to avoid hiccups. These steps show why automated, real-time tracking is a game-changer.

Comparing Expense Tracking Methods

To better understand the differences, here’s a breakdown of how various expense tracking methods measure up in terms of accuracy, efficiency, and compliance:

| Method | Accuracy | Time Required | Compliance | Best For |

|---|---|---|---|---|

| Manual Tracking (spreadsheets, paper receipts) | Low – prone to errors and missing receipts | High – requires lots of manual effort | Difficult – hard to enforce rules | Very small teams with minimal expenses |

| Batch Tracking (periodic processing) | Medium – some automation but delayed error detection | Medium – still involves manual reviews | Moderate – policies enforced after processing | Teams moving away from manual methods |

| Real-Time Tracking (automated sync and capture) | High – instant validation and automated data entry | Low – minimal manual effort needed | Strong – policies enforced as expenses occur | Small teams needing constant visibility and control |

This comparison underscores how real-time tracking outshines other methods by cutting down on manual tasks and keeping financial data up-to-date. It’s a practical solution for small teams aiming to simplify processes while staying on top of their budgets.

sbb-itb-386cb5b

How to Set Up Real-Time Expense Tracking

To establish effective real-time expense tracking, tailor the system to meet your team’s specific needs. This ensures better financial oversight and smoother operations.

Review Your Current Expense Process

Start by mapping out your existing expense workflow, from capturing receipts to final reimbursement. Look for pain points like manual spreadsheet updates or misplaced paper receipts. Engage both your finance team and employees who submit expenses to uncover common delays or errors in the process. Once you’ve identified these issues, you can create policies and categories to simplify and improve expense management.

Create Expense Policies and Categories

Clear expense policies eliminate guesswork and ensure everyone is aligned. Define spending limits and approval workflows for key categories like travel, meals, office supplies, and professional services. For teams in the U.S., include mileage tracking based on the current IRS standard rate, and set guidelines for meal per diems.

To meet IRS requirements, structure your policy as an accountable plan. This means every expense should have a clear business purpose, receipts must be submitted promptly, and any excess reimbursement should be returned.

Next, create expense categories that reflect how you analyze spending, such as operating costs, marketing, travel, or contractor payments. These categories not only simplify tax preparation but also make it easier to spot spending trends.

Using EasyTripExpenses for Real-Time Tracking

Once your process and policies are in place, it’s time to implement a tool that enforces them seamlessly. EasyTripExpenses is a user-friendly platform designed to streamline expense tracking without requiring IT setup or complex integrations. Team members can upload receipts directly from their phones as images or PDFs, categorize expenses instantly, and add any necessary comments.

The platform also handles currency conversion automatically, making it ideal for teams that travel internationally. After logging expenses, professional reports can be generated in seconds, ready for export to PDF for client use or Excel for further analysis.

Pricing options include:

- Starter plan: Free forever, allowing up to 5 receipt uploads per trip.

- Pro plan: $9/month (up to 20 receipt uploads per trip, 3-year history) or $60/year (up to 50 receipt uploads per trip, 5-year history).

Managers can review and approve expenses in real time, cutting out the need to wait until the end of the month. This faster approval process ensures quicker reimbursements and provides your finance team with better cash flow visibility.

Measuring Results and Making Improvements

Once your expense tracking system is up and running, it's essential to ensure it's delivering the value you expect. This means keeping an eye on key metrics that highlight time and cost savings while also identifying areas for improvement. Here’s how you can stay on top of your system’s performance.

Metrics to Track for Small Teams

For small teams, focus on metrics that directly impact your operations. Start by tracking reimbursement turnaround time to ensure employees are reimbursed promptly. If this process is slow, it could signal inefficiencies. Additionally, keep an eye on policy violation rates - a high rate might indicate overly strict guidelines or a need for better employee training.

Another vital metric is month-end close time, which measures how quickly your finance team finalizes monthly records. If this process drags on, it’s a sign that your system needs streamlining. Also, monitor error rates in expense submissions and categorization to identify confusion points. For example, some expense tracking systems have been shown to cut expense report processing time by up to 83%, and teams have reduced corporate card reconciliation time by as much as 90%.

Maintaining Controls and Compliance

To keep your process efficient and compliant, set up automatic alerts for expenses that exceed limits or violate policies. Regular audits are essential - review receipts, verify business purposes, and ensure expenses are categorized correctly to maintain accurate records.

Implement role-based access to streamline approvals. For instance, managers can approve expenses up to $500, while higher amounts require a finance lead’s review. Regularly reviewing expense reports ensures spending stays within budget and helps catch minor errors before they become larger problems.

Using Historical Data to Improve Budgeting

Over time, your expense data becomes an invaluable resource for financial planning. Platforms like EasyTripExpenses retain expense history for 3–5 years, depending on your plan, enabling you to spot spending patterns and make informed forecasts. For example, analyzing quarterly travel expenses can reveal seasonal trends, while comparing vendor spending year-over-year might uncover opportunities for negotiation. If you’ve spent $15,000 with the same hotel chain over 18 months, you could leverage that data to secure corporate discounts.

Historical data also helps create budgets grounded in reality. As Stripe aptly puts it:

"When tracking expenses, you look back in order to plan for what's ahead".

Conclusion

Key Insights for Small Teams

Real-time expense tracking eliminates the need for manual spreadsheets by providing automated, up-to-the-minute data updates. This shift brings several advantages: clearer financial insights, time efficiency, improved accuracy, better cost management, and happier employees. For instance, small businesses using automated accounting tools save around 16 hours monthly, and those adopting automated expense reconciliation can speed up reviews and approvals by as much as four times.

Getting started with these systems involves reviewing your current processes, setting clear goals, and selecting the right solution. For travel-related expenses, tools like EasyTripExpenses streamline everything - from uploading receipts and categorizing expenses instantly to producing professional reports in PDF or Excel formats. Plus, it includes handy features like currency conversion and secure data storage, all without requiring IT expertise.

Once your system is in place, regular evaluation is crucial. Long-term success depends on continuously monitoring performance. Keep an eye on key metrics, collect team feedback, and refine your policies based on real-time insights. Studies show many businesses overspend by 15–20% in certain areas, highlighting the importance of maintaining real-time financial visibility.

These systems also promote smarter decision-making, ensure compliance, and integrate smoothly with existing tools, making them ideal for remote and hybrid teams. By taking this integrated approach, your team can stay agile and maintain financial control.

FAQs

How can real-time expense tracking help small teams manage cash flow more effectively?

Real-time expense tracking gives small teams a clear and up-to-the-minute view of their spending habits. This makes it easier to spot overspending or unexpected expenses early, allowing teams to address these issues before they spiral into bigger problems.

Having access to real-time data means teams can adjust budgets as needed, ensuring money is spent wisely and effectively. This kind of proactive financial management helps avoid unpleasant surprises and keeps the team focused on achieving their financial objectives.

What should small teams look for in a real-time expense tracking system?

When selecting a system for real-time expense tracking, aim for features that make your workflow easier and more efficient. Key functionalities to consider include real-time tracking to keep an eye on expenses as they occur, receipt scanning for fast and hassle-free uploads, and automated reconciliation to cut down on tedious manual work.

It's also important to choose a tool that integrates smoothly with banking and accounting software, ensuring your financial data stays connected and up-to-date. Policy enforcement is another must-have to help maintain compliance with your company's expense guidelines. Finally, opt for platforms with mobile access, allowing your team to manage expenses on the go, no matter where they are.

How does real-time expense tracking help small teams stay compliant with IRS regulations?

Real-time expense tracking plays a crucial role in staying aligned with IRS regulations. By logging business expenses as they happen, it ensures accurate and up-to-date records, which can significantly reduce the chance of errors or misplaced receipts.

With detailed and well-organized records, small teams can easily justify deductions and meet IRS requirements without hassle. This approach not only simplifies tax compliance but also lowers the likelihood of audits by ensuring that every expense is correctly categorized and accounted for.