Expense Categories Checklist for Business Trips

Business travel expenses can add up quickly, but keeping them well-organized ensures compliance with IRS rules and simplifies reimbursements. Here's what you need to know:

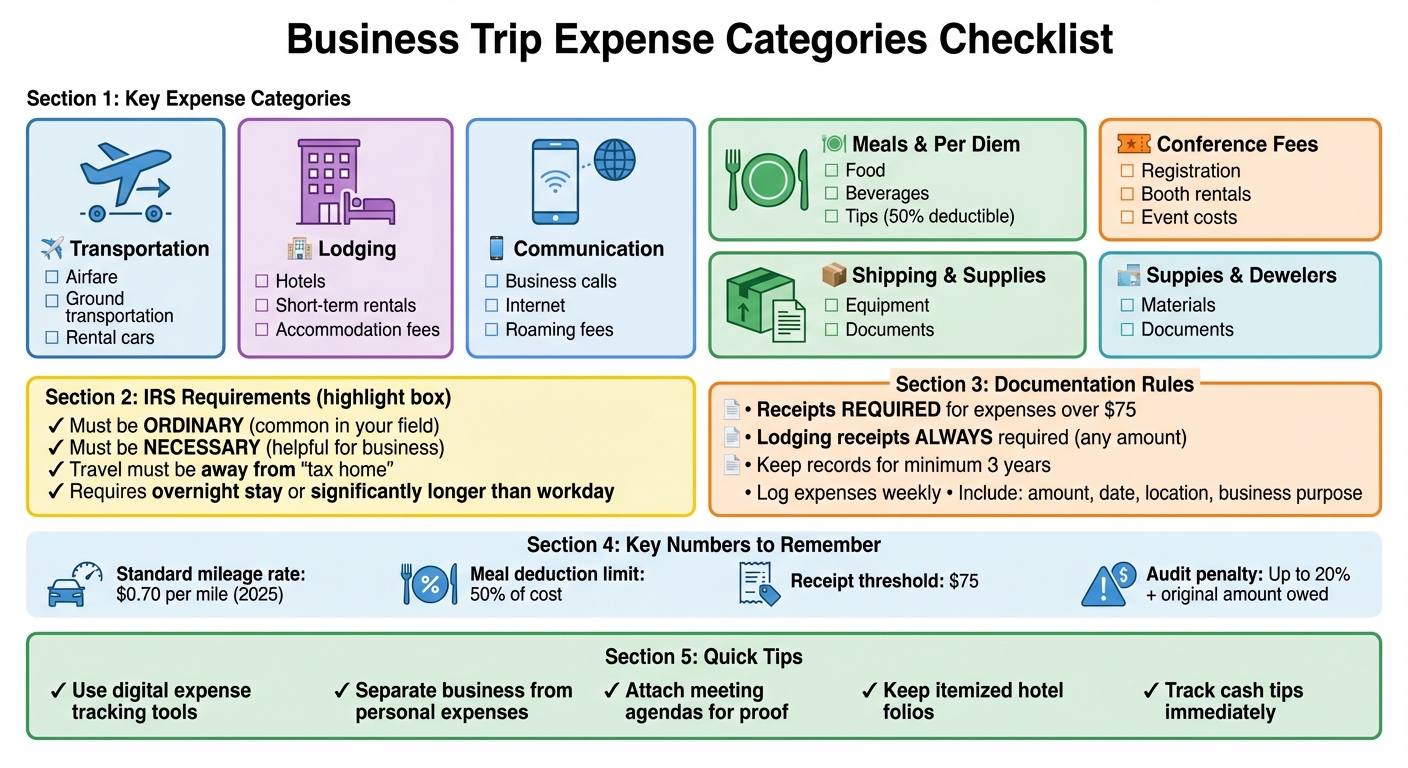

- Key Expense Categories: Airfare, lodging, meals, ground transportation, and conference fees.

- IRS Guidelines: Expenses must be both ordinary (common in your field) and necessary (helpful for business) to qualify for deductions.

- Documentation: Always keep detailed records - receipts for expenses over $75, mileage logs, and clear notes on the business purpose.

- Reimbursable vs. Non-Reimbursable: Business-related costs like flights and client meals qualify, while personal activities like sightseeing do not.

- Tools for Efficiency: Use apps or digital tools to track and categorize expenses in real time.

Proper categorization not only helps with tax deductions but also streamlines reimbursements and reveals spending trends for better financial decisions. Keep your records organized and follow clear policies to avoid audit risks.

Business Trip Expense Categories Checklist with IRS Guidelines

Basic Rules for Categorizing Business Trip Expenses

What Counts as a Business Trip Expense

The IRS has specific rules about what qualifies as a business trip expense. For starters, the travel must take you away from your "tax home." Your tax home isn’t necessarily where you live - it’s the city or general area where your main place of work is located. This means that your daily commute doesn’t count as a business trip, even if it feels like one on a busy day.

Another key factor? The trip needs to last significantly longer than a regular workday and usually requires an overnight stay. For example, a quick meeting in your city won’t make the cut, but a two-day conference in another state will. The expenses you’re claiming also need to meet the IRS’s definition of being both ordinary (common in your line of work) and necessary (helpful for your business).

These guidelines are essential for determining which costs can be reimbursed or deducted.

Reimbursable vs. Non-Reimbursable Expenses

Knowing which expenses your employer will cover can save you from headaches later. Reimbursable expenses are those that directly support your work. Think airfare, hotel stays, taxis or rental cars, meals with clients, and fees for conferences or events related to your job.

On the other hand, personal expenses are usually non-reimbursable. This includes things like sightseeing tours, entertainment unrelated to work, or any leisure activities you decide to squeeze in during your trip. If your travel mixes business with personal activities, only the business-related costs can be claimed.

Getting this classification right is crucial for smooth reimbursement and proper record-keeping.

Documentation and Reporting Requirements

Proper documentation is a must when it comes to claiming or deducting business trip expenses. The IRS expects you to keep detailed records for each expense, including the amount, date, location, and the business purpose. For lodging, a receipt is mandatory no matter the cost. For other expenses, receipts are required only for individual items costing $75 or more.

It’s a good idea to log your expenses at least once a week. Attach supporting documents like meeting agendas or notes to show the trip’s business purpose. Keep in mind, credit card statements alone won’t cut it - you’ll need original receipts that clearly show what was purchased.

Keeping your records organized not only ensures compliance but also makes reporting less of a hassle.

Transportation Expense Categories Checklist

Airfare and Related Costs

Airfare often represents a significant transportation expense. This category includes plane tickets, airline baggage fees, seat upgrades required for business purposes, and any fees for changing tickets. Be sure your receipts clearly display travel dates and destinations. For connecting flights or multi-city trips, keep all boarding passes and confirmation emails together to verify the business purpose of your travel.

According to the IRS, these expenses are deductible as long as they are ordinary, necessary, and not overly lavish. However, if you add a personal side trip or extend your stay for leisure, the additional costs won't qualify for deductions.

It's equally important to track all ground transportation costs accurately to support your claims.

Ground Transportation

When you reach your destination, ground transportation expenses can include rental car fees, fuel, and insurance. If you’re using your personal vehicle, you have two deduction options: actual expenses (e.g., gas and oil) or the standard mileage rate, which is $0.70 per mile for 2025. Business-related tolls and parking fees are deductible separately.

Other eligible ground transportation costs cover rideshare services like Uber or Lyft, traditional taxis, public transportation passes, and intercity buses or trains.

For personal vehicle use, keeping a detailed mileage log is crucial. Include odometer readings, trip dates, destinations, and the business purpose of each trip. Updating these logs weekly can help ensure accuracy. Additionally, retain electronic statements (like E-ZPass or FasTrak records) to document applicable expenses.

Required Documentation

Proper documentation is key to meeting IRS standards and company policies for transportation expenses. This complements broader guidelines for recording business trip expenses.

Keep receipts and supporting documents that show the amount, date, location, and business purpose for any expense over $75. Be sure to note who you met with, what was discussed, and why the trip was necessary for your work. Most companies require expense reports to be submitted within 30 to 60 days of travel, and the IRS advises retaining these records for at least three years. Using digital tools or apps to log expenses in real time can help you avoid losing receipts and ensure accuracy.

Lodging and Accommodation Categories Checklist

Hotel and Short-Term Rentals

When it comes to lodging expenses, hotel room rates, taxes, and resort fees typically make up the bulk of the costs. If you're traveling overnight for business outside your tax home, the IRS generally allows these expenses to be fully deductible - as long as they’re reasonable and not excessive. Extravagant accommodations, however, could raise red flags during an audit.

To ensure compliance, keep detailed records. Your hotel folio should include an itemized breakdown of charges, such as the room rate, taxes, and resort fees, along with the hotel’s name, location, check-in and check-out dates, and nightly rates. If you’re using short-term rentals, the same rules apply. Save all confirmation emails and receipts for documentation.

"You must keep adequate records proving the lodging expense. This typically requires documentary evidence like hotel receipts (folios) showing the name, location, dates of stay, and separate amounts for lodging versus other charges like meals or phone calls."

When submitting your expense report, include the business purpose of your trip - whether it’s a client meeting, conference, or site visit. Be sure to also include your employee details and travel dates. Breaking down any extra charges for services separately helps clarify your lodging expenses even further.

Additional Accommodation Costs

Lodging expenses don’t end with the room charges. Other costs, such as hotel parking fees, tips for staff, and internet charges needed for business purposes, can also be deductible. These should be listed as separate line items in your expense report to ensure accurate categorization.

For example, parking fees might fall under "miscellaneous" expenses if your company’s system requires that level of detail. Similarly, business-related internet charges could be classified as "Other Direct Costs". Your expense management system should clearly distinguish these additional costs from the core lodging expenses.

Don’t forget to document smaller expenses, like cash tips for housekeeping or bellhops, as these may not appear on your final hotel bill. Recording them promptly helps ensure all legitimate business costs are accounted for.

Meals, Per Diem, and Incidentals Checklist

Meals and Tips

Meal expenses include everything from food and beverages to delivery fees, sales tax, and tips during overnight business trips. These costs apply whether you're dining solo or with business associates. However, the IRS caps the deduction for business meals at 50% of the unreimbursed cost, regardless of who you're dining with.

When it comes to reimbursement, companies typically choose between two methods: per diem rates or actual expense reimbursements. With the per diem approach, you’re given a fixed daily allowance based on your travel destination, and while detailed receipts aren’t usually required, it’s wise to keep them for potential audits. On the other hand, actual expense reimbursement requires employees to submit detailed receipts, especially for amounts exceeding $75. Whether you’re using the actual cost of meals or the standard meal allowance, the IRS still applies the 50% deduction rule.

"Even if you use the federal meals and incidental expense per diem rates to calculate your deductions, be sure to keep receipts from all your meals and incidental expenses." - TurboTax Tip

To document meal expenses properly, include key details like the time, location, and business purpose. For meals shared with clients or associates, also note who attended and the business topics discussed. It’s essential to ensure that all claimed meal costs are reasonable and don’t fall into the category of lavish or extravagant by IRS standards.

Don’t overlook smaller, necessary expenses that fall under incidentals - they can add up quickly.

Incidentals

Incidentals cover minor but important costs, such as tips for hotel staff, porters, baggage handlers, and charges for laundry or dry cleaning. If you’re using the per diem method, these incidental expenses are already included in the Meals and Incidental Expenses (M&IE) allowance. For federal employees, the M&IE reimbursement on travel days (both the first and last) is limited to 75% of the daily rate.

Keep track of all incidental expenses, even cash tips that don’t come with receipts, like those given to a bellhop or shuttle driver. It’s also important to note that the lodging per diem is strictly for accommodation costs and cannot be used interchangeably with the M&IE allowance.

sbb-itb-386cb5b

How to Deduct Business Travel Expenses in 2024

Trip-Related Fees and Other Categories

When documenting business expenses, it’s important to account for additional costs that often arise during trips. These fees and categories deserve careful attention to ensure accurate reporting.

Conferences and Events

Expenses related to attending conferences, trade shows, seminars, or other professional events can be deducted as business costs. This includes registration fees that cover access to workshops, sessions, and educational materials aimed at professional growth. If you’re participating as an exhibitor, costs like booth rentals, display materials, and shipping fees for your setup also qualify.

Beyond registration, other event-related expenses may include renting meeting spaces for client discussions, catering services, or sponsorship fees to promote your business during the event. Internet access charges incurred during the event for business purposes are also deductible.

Shipping and Communication Costs

Travel often involves additional logistical expenses, such as shipping and communication. For example, shipping costs for baggage, product samples, display materials, or business equipment between locations are deductible. This also includes printing and shipping business documents while on the road - just make sure to keep invoices that clearly indicate the business purpose.

Communication costs are another key category. Business calls made during trips, whether via phone, fax, or other methods, can be claimed. This extends to mobile roaming fees, hotel Wi-Fi charges, internet access fees, and even hotel phone usage. The IRS emphasizes that these expenses must be “ordinary and necessary” for your business, and proper documentation is crucial to avoid issues with deductions. As the IRS states, “Good records are essential”.

Other Business Support Costs

Business trips sometimes require incidental purchases or services that support your work. Emergency buys, like stationery, notebooks, or other office supplies needed to get the job done, are deductible. If you need to rent equipment, such as computers, or hire professional services like a public stenographer, those costs are also eligible.

For remote employees working during business trips, renting coworking spaces or meeting rooms can be claimed as a business expense. Additionally, international travelers can deduct currency exchange fees and bank charges tied to business transactions. Just ensure every expense is clearly linked to a business purpose and well-documented.

Category Consistency and Report Formatting Standards

Consistent Expense Mapping

Accurate reporting starts with mapping expenses to well-defined categories. Your company’s travel expense policy should clearly outline categories like Transportation, Lodging, Meals, Entertainment, Supplies, and Incidentals to ensure everyone understands what qualifies as an eligible expense. Each category should include specific spending limits and detailed guidelines. Training employees on how to code expenses consistently is especially important for incidental items that might otherwise create confusion between categories. Clear instructions help avoid misunderstandings and ensure uniformity in how reports are prepared. Additionally, assigning distinct general ledger accounts for each expense type and regularly reviewing these policies can help maintain consistency over time. This structured approach lays the groundwork for precise and reliable reporting.

Report Layout Guidelines

Once expenses are consistently mapped, having a standardized report layout ensures that information is communicated clearly. A well-organized expense report should include key details for every transaction: the date, merchant name, category, description, amount (in USD), and payment method. To support compliance and verification, attach itemized receipts as digital files in formats like PDF, JPEG, or PNG. Using a single, standardized template across the organization simplifies data entry and approval processes, while also making reports easier to review. For international travel, make sure currency conversions to USD are accurate, and include notes or justifications for any expenses that fall outside standard guidelines.

Using Tools for Expense Reporting

Expense reporting tools that incorporate company policies directly into the platform can enforce rules in real time, reducing errors in categorization. For example, EasyTripExpenses allows users to upload receipts, assign expenses to predefined categories, add comments, and generate polished reports in PDF or Excel formats. The platform handles currency conversions automatically and securely stores trip histories, eliminating the need for IT setup while keeping all expense data organized and accessible. These automated tools not only simplify the categorization process but also reinforce the consistency and clarity established by standardized policies and layouts.

Conclusion

Managing business trip expenses becomes far easier with a well-organized checklist. By setting up a clear system to categorize expenses - covering everything from airfare and hotel stays to meals and conference fees - you can ensure every deductible cost is accounted for while staying within IRS guidelines. This not only keeps your business compliant but also shields you from audit risks and potential penalties, which can be as high as 20% of the difference owed, plus the original amount, for improper deductions.

"Proper classification and documentation ensure businesses maximize allowable deductions without risking audit complications or penalties." - Emburse

But it’s not just about compliance. A structured approach to tracking expenses turns reporting into a tool for smarter financial management. Accurate classification allows finance teams to quickly spot spending trends, make better decisions about future travel policies, and eliminate unnecessary costs. On top of that, it speeds up reimbursements, easing the administrative workload . When everyone knows what counts as a business expense and how to document it correctly, the whole process becomes seamless.

FAQs

What is the best way to track and manage expenses during business trips?

Managing expenses on business trips doesn't have to be a hassle. Tools like EasyTripExpenses make the process much simpler. This tool lets you upload receipts, organize expenses into categories, and create professional reports in PDF or Excel formats. It also includes helpful features like secure data storage, automatic currency conversion, and no need for complicated IT setups - perfect for small teams or startups.

With tools like these, you can keep all expenses accurately tracked and neatly organized, saving time and cutting down on mistakes in your reports.

What’s the best way to know if a business trip expense qualifies for reimbursement?

To figure out if an expense qualifies for reimbursement, ask yourself if it’s ordinary and necessary for the business, directly connected to the trip, and aligns with your company’s rules. Expenses that are personal, excessive, or unrelated to work won’t make the cut.

Always keep thorough records, like receipts and notes explaining the business purpose, to back up your claims. Good documentation not only speeds up the reimbursement process but also helps prevent any hiccups along the way.

What records do I need to keep for business trip expenses to comply with IRS guidelines?

To align with IRS requirements, it’s important to maintain thorough records of your business trip expenses. These records should include receipts, invoices, and logs that detail the amount, date, location, and business purpose for each expense. Examples of useful documentation include travel expense reports, credit card statements, and mileage logs for any vehicle usage.

Make sure to track all relevant costs, such as transportation, lodging, meals, and other expenses tied to your business activities. Staying organized and keeping accurate records not only ensures compliance but also simplifies the process when it’s time to file your taxes.