Business Travel Expense FAQs Answered

Business travel expenses can account for 10-20% of a company's operating budget, making them a major focus for cost management. With rising travel costs - up 11% in 2024 - and challenges like delayed reimbursements, unclear policies, and lost receipts, many employees and employers face difficulties managing these expenses effectively. Here's a quick breakdown of what you need to know:

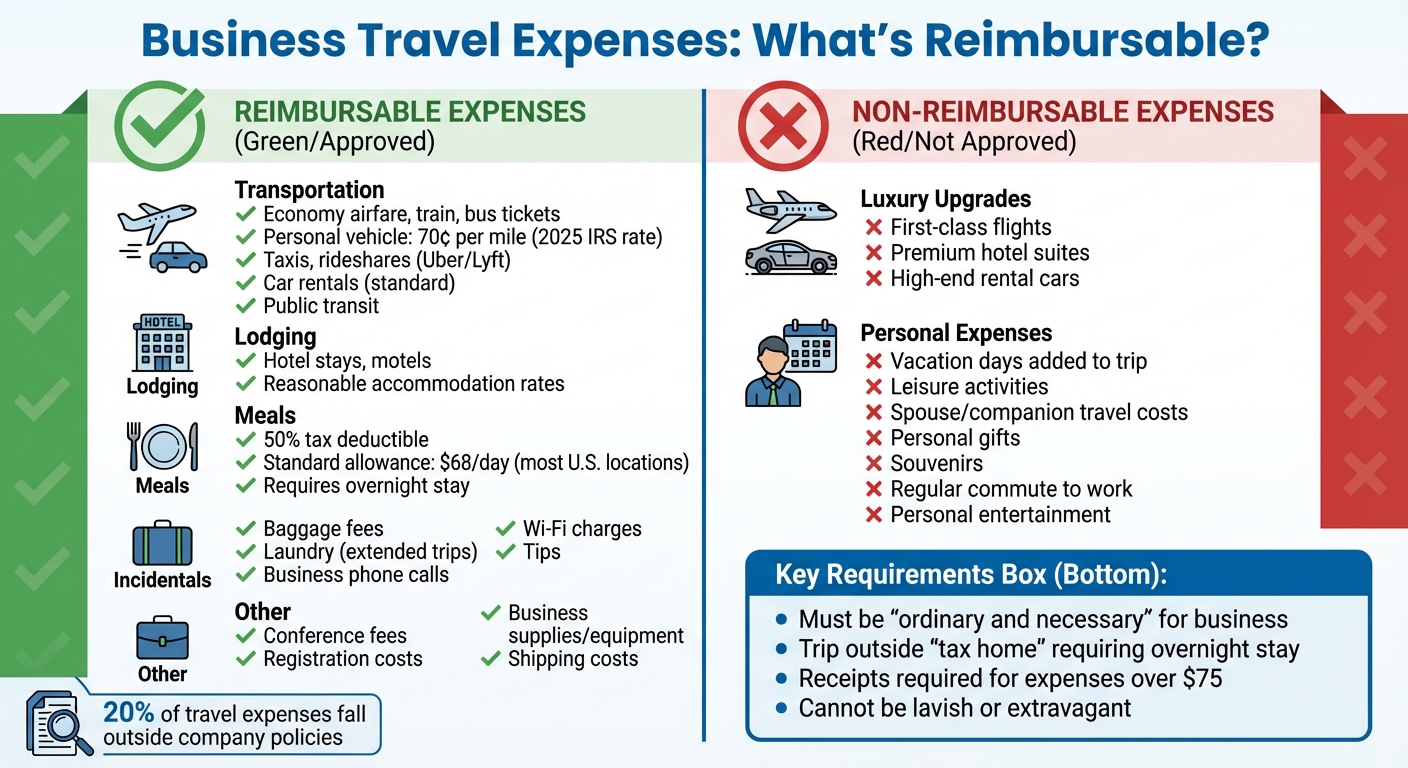

- What qualifies as a business expense? Costs like transportation, lodging, meals (50% deductible), and incidentals tied to work-related travel outside your tax home.

- Reimbursable vs. non-reimbursable expenses: Standard costs like economy airfare and reasonable hotels are reimbursable, but personal expenses (e.g., spouse travel, souvenirs) are not.

- Tracking and submitting expenses: Log expenses in real time, keep receipts (required for expenses over $75), and submit detailed reports promptly.

- Travel policies: Clear guidelines help define eligible expenses, spending limits, and exceptions, reducing confusion and fraud risks.

- Reimbursement timelines: Typically 15-30 days for private companies; delays often stem from missing receipts or errors.

- Corporate cards vs. personal cards: Corporate cards simplify tracking and reduce out-of-pocket spending, while personal cards require manual reporting.

Managing business travel doesn’t have to be overwhelming. By understanding policies, separating personal and business expenses, and using tools like automated expense systems, employees and employers can save time and minimize frustrations.

Managing Business Travel Expenses Made Easy

What Counts as Business Travel Expenses

Business Travel Expenses: Reimbursable vs Non-Reimbursable Costs Guide

Business travel expenses are the costs employees incur when they travel away from their primary workplace for work-related purposes. According to IRS guidelines, a trip qualifies as business travel if it takes an employee outside their "tax home" (the main place of business) for longer than a regular workday and requires rest or an overnight stay. Additionally, these expenses must be both "ordinary and necessary", meaning they are typical in your industry and appropriate for your business.

Types of Business Travel Expenses

Business travel expenses fall into several categories:

- Transportation: This includes airfare, train tickets, bus fares, and car-related costs. If you're using your personal vehicle, you can claim the IRS standard mileage rate, which is set at 70 cents per mile for 2025. Local transportation, such as taxis, rideshares (like Uber or Lyft), car rentals, and public transit used to travel between your hotel and business meetings, also qualifies.

- Lodging: Hotel stays, motels, or similar accommodations during your trip are covered.

- Meals: Meal costs are reimbursable if an overnight stay is required. However, companies can typically only deduct 50% of these expenses for tax purposes. For most U.S. locations, the standard meal allowance is $68 per day.

- Incidentals: These cover expenses like baggage fees, laundry for extended trips, business-related phone calls, Wi-Fi charges, and related tips.

Other reimbursable expenses include conference fees, registration costs for business events, and necessary business supplies or equipment, including their shipping costs.

Reimbursable vs. Non-Reimbursable Expenses

Not every expense from a business trip qualifies for reimbursement. Companies generally cover standard costs, such as economy airfare, reasonable hotel rates, and basic ground transportation. However, luxury upgrades - like first-class flights, premium hotel suites, or high-end rental cars - are typically not reimbursed unless explicitly approved by company policy.

Personal expenses remain non-reimbursable. These include vacation days added to a business trip, leisure activities, travel costs for a spouse or companion (unless they have a legitimate business role), personal gifts, souvenirs, and your regular commute to work. For example, if you bring your spouse to a conference and book a larger hotel room, only the portion of the cost related to your stay is reimbursable. Additionally, expenses must not be considered lavish or extravagant to qualify.

Clearly identifying and categorizing expenses helps ensure business and personal costs remain separate.

Separating Personal and Business Expenses

When combining personal and business travel, it's crucial to separate expenses. The "primary purpose" rule determines what qualifies as reimbursable: if the trip is primarily for business but includes some personal time, only the business-related expenses are covered. On the other hand, if the trip is mainly for personal reasons with minor business activities, travel costs to and from the destination are generally not reimbursable.

For instance, if you fly to Los Angeles for a 5-day business conference but extend your stay by 3 days for vacation, your company would reimburse travel, lodging, and meal expenses for the 5 business days only. Similarly, if you attend a week-long meeting in London but spend additional days sightseeing, only the business-related portion of the trip is eligible for reimbursement.

To ensure smooth reimbursement and proper documentation, keep detailed records of each expense. Include the amount, date, location, business purpose, and names or titles of attendees. Receipts are typically required for expenses over $75, which is especially important for audits and accurate reimbursement processing.

Creating Travel Expense Policies

A well-thought-out travel expense policy helps control costs while offering clear guidelines for employees. It should establish its scope, define eligible expenses, and explain the approval process. Responsibilities should also be clearly outlined: employees need to submit accurate reports and secure pre-approvals, managers should review requests, and finance teams handle reimbursements. This structure helps ensure smooth tracking and reimbursement later.

What to Include in a Travel Expense Policy

Start by detailing which expenses qualify for reimbursement - think transportation, lodging, meals, and incidentals. For example, many companies specify economy airfare for domestic flights. Include any pre-approval requirements, particularly for international travel or high-cost items. Just as important, spell out what won’t be reimbursed, such as personal entertainment, luxury upgrades, or travel expenses for non-business companions.

Make sure to document the approval workflow clearly, so employees know who authorizes travel requests and expense reports. Including examples can make the process easier to understand. Using simple, straightforward language increases the likelihood that employees will follow the policy consistently.

Setting Spending Limits for Travel

Define spending limits for each category, keeping regional cost differences in mind. For instance, hotel allowances should reflect local pricing. Many companies use IRS per diem rates - around $68 per day for meals in most locations - as a starting point, though these can be adjusted based on budget considerations.

Research shows that nearly 20% of travel and entertainment expenses fall outside company policies, highlighting the need for clear limits. In 2025, Sana Benefits introduced flexible spending rules allowing bookings up to 25% above market rates. Caroline Hill, Assistant Controller, noted:

"The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us".

To make compliance easier, integrate these limits into your expense management software. This way, employees can see approved options when booking travel. Automated systems can flag out-of-policy expenses in real time, reducing the need for manual reviews and simplifying enforcement.

Managing Policy Exceptions

Even the best policies need room for exceptions. Create a process for employees to explain why they need to exceed standard limits and identify who can approve these requests. For example, a last-minute flight might exceed the usual cap, or an employee with mobility challenges might require business class on a long international trip.

Use software to flag non-compliant expenses and streamline exception reviews. For instance, in October 2024, HelloFresh worked with Navan to implement dynamic policy controls. These controls made it easier for employees to find compliant travel options, improving adherence and cutting down on manual exception handling. Their "soft stop" approach - asking employees for an explanation rather than outright rejecting expenses - keeps operations running smoothly while ensuring oversight.

Keep a record of all approved exceptions and review them regularly. Combining clear policies with manageable exceptions creates a more efficient expense reporting process. Annual reviews can help ensure spending limits stay aligned with market rates and business needs.

Tracking and Submitting Expenses

Keeping track of expenses in real time can make filing reports quicker and more accurate. Waiting to log expenses increases the chance of losing receipts or forgetting important details. By tracking as you go, you gain immediate insight into your spending and can better stick to your budget during the trip.

How to Track Expenses During a Trip

Make it a habit to log every expense right away. Snap a photo of each receipt as soon as you get it. If you're using a personal card, be sure to label business-related charges immediately. For meals, jot down who attended and the purpose of the meeting while it’s still fresh in your mind. Many modern systems now use AI to automatically categorize expenses, making the process even smoother. This kind of real-time tracking not only saves time but also keeps you organized. Just remember to document everything within 60 days to comply with IRS rules.

How to Submit Expense Reports

Once your expenses are logged, it’s time to compile your report. Gather itemized receipts and include key details like dates, locations, and the business purpose of each expense. Double-check that everything aligns with your company’s travel policy before submitting. Proper documentation ensures your reimbursement remains non-taxable under IRS accountable plan rules.

Research shows that companies can lose up to 5% of their revenue each year due to expense fraud and policy violations. Submitting your report on time, as required by your company, helps avoid delays in getting reimbursed.

Using EasyTripExpenses for Reporting

EasyTripExpenses takes the hassle out of expense reporting. You can upload receipts directly from your phone as images or PDFs, categorize each expense, and add notes about the business purpose - all in one place. For international trips, the platform automatically handles currency conversions, so you don’t have to.

When your report is ready, EasyTripExpenses generates professional PDFs or Excel files with just a few clicks. Your data is securely encrypted, and there’s no need for complicated IT setups. Plus, the platform keeps a record of your trip history - from one year with the free Starter plan to five years with the Pro plan - making it easy to review past expenses or identify spending patterns. This tool simplifies reporting and helps you stay on top of your travel expenses effortlessly.

sbb-itb-386cb5b

Reimbursements and Travel Advances

Typical Reimbursement Timelines

Reimbursement timelines depend on whether you're employed by a federal agency, state government, or a private company. Federal employees can generally expect to be reimbursed within 30 calendar days after submitting a proper travel claim. Similarly, California state law mandates employers to process reimbursements within 30 days of receiving the request. For private companies, the process typically takes anywhere from a few days to several weeks, with many adhering to a timeline of 15 to 30 working days.

Delays often happen due to missing receipts, errors in submissions, or slow responses from finance teams. To avoid these setbacks, submit your expense reports promptly, ensure all receipts are included, and respond quickly to any follow-up requests from your finance department. Clear documentation and timely submissions not only help speed up reimbursements but also support the use of travel advances.

Travel advances, in particular, can ease the burden of covering expenses upfront.

How Travel Advances Work

Travel advances provide employees with funds before their trip to cover expected expenses. This can help avoid the stress of paying out of pocket for larger costs like flights or hotel stays. Advances are typically issued as cash or prepaid cards.

To keep these advances non-taxable, companies must follow IRS "accountable plan" guidelines. These rules require employees to account for their expenses within 60 days of incurring them and return any unused funds within 120 days. Missing these deadlines could result in the advance being classified as taxable income. Once your trip is over, you'll need to reconcile the advance by submitting receipts and documentation for all expenses. Any unspent funds should be returned to your employer.

Corporate Cards vs. Personal Cards for Travel

While travel advances cover upfront costs, corporate cards offer a streamlined way to manage expenses. Corporate cards come with several benefits that make life easier for both employees and employers. They eliminate the need for employees to pay large expenses out of pocket, reducing financial strain - a problem faced by 83% of employees who struggle with fronting travel costs. These cards also allow for real-time tracking of expenses and include built-in controls to prevent spending beyond company policy limits.

On the other hand, using personal cards for business travel can create extra administrative work. Employees often spend about 20 minutes completing an expense report, and nearly 20% of those reports contain errors, which adds another 18 minutes to the process. Plus, 1 in 4 business travelers admit to losing receipts during their trips. Corporate cards, which integrate directly with expense systems, help reduce manual entry and the risk of lost receipts. Companies may also enjoy perks like cashback rebates and financial incentives on purchases made with these cards.

Special Travel Situations

Travel often involves more than just booking flights and hotels. Unique scenarios require specific strategies to manage expenses effectively.

Managing Trip Changes or Cancellations

Canceled flights can lead to thousands of dollars in unused credits every year. To address this, companies should require employees to book flights using corporate credit cards. This gives the finance team visibility into cancellations and ensures unused credits stay with the company rather than being lost in personal accounts.

If an employee uses a personal card, reimbursement should be delayed until the flight credit is reassigned. Additionally, if the airline cancels a flight, travelers may be entitled to a full refund - even on non-refundable tickets. According to the U.S. Department of Transportation, refunds are required when airlines cannot provide a suitable alternative.

For non-refundable tickets that need changes, airline change fees can be covered as business expenses. If the ticket goes entirely unused, employees will often need to submit an Unused Air Ticket Affidavit for reimbursement. Some airlines, such as Alaska, American, Delta, and United, allow name changes through corporate booking tools. This means if the original traveler has no upcoming trips, the credit can be transferred to another employee.

These practices also apply to more complex travel scenarios, like combining business with personal travel or managing international trips.

Combining Business and Personal Travel

When mixing business with leisure, it’s essential to separate expenses accurately. For example, airfare is fully deductible if the trip’s primary purpose is business.

However, lodging and rental cars require more scrutiny. The company can only cover the cost of a single room for the business portion of the trip. If an employee upgrades to a suite to accommodate family members, the additional cost is personal. The same rule applies to rental cars - if the car is necessary for business, the full cost may qualify as a business expense. But if the rental is only for personal use, the employee is responsible for the cost.

Employees should keep detailed records to show which days were strictly for business. Only those days qualify for lodging, transportation, car rentals, and 50% of meal costs. Expenses for personal entertainment or family members are not eligible for reimbursement.

Handling International Travel Expenses

International travel introduces additional complexities, such as currency conversions and varying tax rules. As with domestic travel, maintaining detailed and timely records is essential. Automated expense management systems simplify this process by applying accurate exchange rates at the time of each transaction and categorizing expenses according to local tax regulations. This reduces errors and eliminates guesswork.

Platforms like EasyTripExpenses consolidate international spending into a single dashboard, offering real-time visibility across currencies and regions. These tools also integrate with tax engines to calculate and process VAT/GST refunds automatically, ensuring no eligible reimbursement is overlooked.

For meal and incidental allowances during international trips, many companies rely on government-specified per diem rates that vary by location. This approach keeps costs predictable and simplifies expense tracking. Automated systems can apply the correct rate based on the traveler's destination, eliminating confusion about what’s reasonable to spend in cities like Tokyo or London.

Conclusion

Having clear policies in place helps set spending limits, clarify reimbursable items, and establish consistent processes. This not only reduces the risk of fraudulent spending but also empowers travelers to make informed decisions during their trips.

Real-time tracking simplifies expense management by preserving receipts and organizing reports. Tools like EasyTripExpenses use automation to scan receipts, enforce policy rules upfront to flag non-compliant expenses, and give finance teams instant visibility into company spending. Additionally, corporate cards and automated platforms centralize transactions, cut down on out-of-pocket expenses, streamline approval workflows, and speed up reimbursements.

FAQs

What’s the best way to track and manage business travel expenses?

To keep business travel expenses organized and manageable, start by establishing clear rules for pre-approvals and reimbursement policies. This ensures everyone knows what’s covered and avoids unnecessary confusion. Providing employees with a company credit card can also make expense tracking easier and centralize spending.

Another smart move is using an automated expense reporting tool. These tools help save time, cut down on mistakes, and make the entire submission process more straightforward for everyone involved.

You might also want to introduce a per diem system, which sets daily spending limits. This approach not only simplifies budgeting but also helps ensure your business stays in line with IRS guidelines. By combining these methods, you can simplify expense management for employees and make life easier for your accounting team.

Why should I use a corporate card instead of a personal card for business travel expenses?

Using a corporate card for business travel brings multiple benefits. For starters, these cards often offer higher credit limits, which can be a lifesaver when facing larger or unexpected expenses on the road. They also come equipped with tools for tracking and reporting expenses, making it easier to stay organized and cut down on the hassle of reimbursement paperwork.

Another key advantage is that corporate cards help keep personal and business finances separate, which simplifies tasks like tax preparation and audits. On top of that, they usually include advanced security features like fraud protection and purchase monitoring, providing extra peace of mind during trips. In short, corporate cards make managing travel expenses smoother and more efficient for both employees and employers.

How should companies manage travel expenses for trips that mix business and personal activities?

When it comes to handling travel expenses for trips that mix business with personal activities, having a well-defined reimbursement policy is a must. This policy should clearly state which expenses are eligible for reimbursement - like airfare or accommodations tied to the business portion of the trip - while excluding any costs related to personal activities.

Employees need to keep business-related expenses separate from personal ones, making sure to provide detailed receipts and explanations when submitting their expense reports. Using an expense tracking tool can simplify this process, ensuring everything is accurate and organized. Clear communication of these rules is key to avoiding misunderstandings and keeping everything straightforward.